Which Is The Best Compound Interest Calculators for Students

Compound interest calculators are invaluable for students to understand how their investments or savings grow over time. They help visualize the effects of interest compounding, which can be crucial for both personal finance management and academic understanding. Below is a comprehensive guide to some of the best compound interest calculators, highlighting their features, pros, and cons.

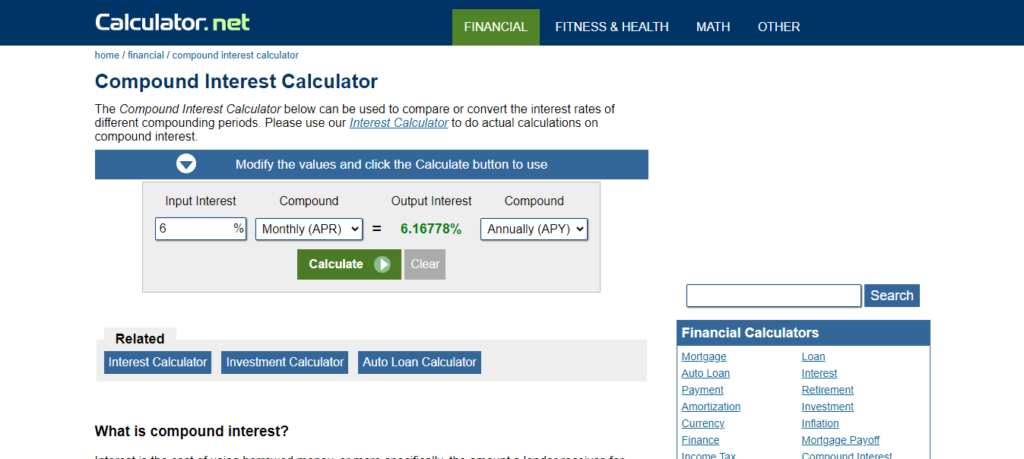

1. Calculator.net Compound Interest Calculator

Description:

Calculator.net offers a straightforward online compound interest calculator. It allows users to input the initial principal amount, annual interest rate, number of compounding periods per year, and investment duration. Users can also include additional regular deposits or withdrawals.

Features:

- Customization of Compounding Frequency: Choose from annual, semi-annual, quarterly, monthly, or daily compounding.

- Detailed Breakdown: Provides a clear summary of principal, interest earned, and future value.

- Visual Graphs: Displays growth over time through charts.

Pros:

- Ease of Use: Simple and intuitive interface suitable for beginners.

- Free Access: No cost involved, and it can be accessed from any device with internet.

- Educational Value: Offers visual aids to better understand interest accumulation.

Cons:

- Limited Offline Access: Only available online; no mobile app or offline version.

- Basic Features: Advanced scenarios may require a premium version.

2. Investopedia Compound Interest Calculator

Description:

Investopedia’s calculator is a comprehensive tool for understanding compound interest. It allows for input of initial investment, annual interest rate, number of years, and compounding frequency. The results include detailed information on total interest earned and future value.

Features:

- Customizable Inputs: Adjust initial amount, interest rate, duration, and compounding frequency.

- Detailed Results: Provides a thorough breakdown of future value and interest earned.

- Educational Resources: Includes explanations and additional information on compound interest.

Pros:

- User-Friendly Design: Clean and visually appealing layout.

- Free to Use: Accessible without any cost, with educational support.

- Clear Explanations: Helpful for understanding the underlying financial concepts.

Cons:

- Limited Advanced Features: Basic functionality may not cover all complex scenarios.

- Web-Based Only: No mobile app or offline functionality.

3. Bankrate Compound Interest Calculator

Description:

Bankrate’s compound interest calculator is designed for those who need a detailed analysis of their investments. It supports various compounding frequencies and allows users to input regular contributions, providing a comprehensive view of how investments grow over time.

Features:

- Flexible Inputs: Allows for customization of initial investment, interest rate, time period, and compounding frequency.

- Visual Growth Chart: Displays a graphical representation of how investments accumulate.

- Detailed Output: Offers a breakdown of future value and total interest earned.

Pros:

- In-Depth Analysis: Provides detailed results and charts for better understanding.

- No Registration Required: Use the basic features without creating an account.

- Free Access: Available at no cost on the Bankrate website.

Cons:

- Advertisements: The website includes ads which might be distracting.

- Complex Scenarios: Some advanced calculations may require additional tools or subscriptions.

4. Financial Calculator App (Mobile)

Description:

The Financial Calculator app provides a suite of financial calculators, including a compound interest calculator, available for both iOS and Android devices. It allows users to perform calculations on-the-go and customize scenarios as needed.

Features:

- Mobile Accessibility: Available as an app for both major mobile platforms.

- Multi-Functionality: Includes various financial calculators in one app.

- Customizable: Allows for detailed adjustments and input of additional contributions.

Pros:

- Convenience: Portable and suitable for on-the-go calculations.

- Versatility: Offers multiple financial tools beyond just compound interest.

- Graphical Results: Provides visual representations of calculations.

Cons:

- Paid Features: Some advanced functionalities require a paid version.

- Interface Complexity: The app can be cluttered with multiple tools and options.

5. Excel Compound Interest Calculator Template

Description:

The Excel compound interest calculator template is a customizable spreadsheet tool available in Microsoft Excel or Google Sheets. It allows students to tailor their calculations and create detailed projections based on their specific scenarios.

Features:

- High Flexibility: Users can modify formulas and inputs to fit various needs.

- Custom Scenarios: Adaptable for complex calculations and different compounding frequencies.

- Graphical Elements: Users can create charts to visualize growth over time.

Pros:

- Customizable: Highly adaptable for individual requirements.

- Widely Used: Familiarity with Excel or Google Sheets can be an advantage.

- No Additional Cost: Typically included with office software or free Google Sheets.

Cons:

- Requires Knowledge: Basic understanding of spreadsheets and formulas needed.

- No Pre-Built Visuals: Requires manual setup for charts and visual aids.

Conclusion

Choosing the best compound interest calculator depends on the student’s needs, such as the level of detail required, accessibility preferences, and whether a mobile or web-based tool is preferred. For ease of use and straightforward calculations, Calculator.net and Investopedia are excellent options. For detailed analysis and visual aids, Bankrate and mobile apps offer comprehensive tools. For those comfortable with spreadsheets, the Excel template provides unparalleled flexibility.

Each tool has its own set of advantages and limitations, so students should select one that best fits their financial learning goals and technical comfort level.