What is Continuous Compound Interest Calculator & How It Works

In the world of finance and investment, compound interest is a well-known concept that allows your money to grow exponentially over time. While most people are familiar with standard compound interest, where interest is calculated at regular intervals (like annually or monthly), there is another, more powerful variant known as continuous compound interest. A Continuous Compound Interest Calculator is a tool designed to compute the future value of an investment or loan that compounds continuously, offering a more accurate reflection of potential growth over time.

What is Continuous Compound Interest?

Continuous compound interest is a mathematical concept where interest is calculated and added to the principal at every possible moment. Instead of compounding at regular intervals, the interest compounds continuously. This results in a higher return over time compared to traditional compounding intervals like yearly or monthly.

The formula for continuous compound interest is:

[

A = P \cdot e^{(r \cdot t)}

]

Where:

- ( A ) is the amount of money accumulated after ( t ) years, including interest.

- ( P ) is the principal amount (the initial investment).

- ( r ) is the annual interest rate (in decimal form).

- ( t ) is the time the money is invested for (in years).

- ( e ) is Euler’s number (approximately 2.71828), the base of the natural logarithm.

How Continuous Compound Interest Works

To understand the power of continuous compounding, let’s compare it with standard compounding methods:

- Annual Compounding: Interest is calculated and added once a year.

- Quarterly Compounding: Interest is calculated and added four times a year.

- Monthly Compounding: Interest is calculated and added twelve times a year.

- Continuous Compounding: Interest is compounded an infinite number of times per year.

As the frequency of compounding increases, the total amount of interest earned also increases. Continuous compounding represents the theoretical maximum amount of interest that can be earned on an investment.

Practical Example

Let’s assume you invest $1,000 at an annual interest rate of 5% for 5 years. Using the continuous compound interest formula:

- Principal (( P )): $1,000

- Rate (( r )): 0.05 (5% per year)

- Time (( t )): 5 years

Plugging these values into the formula:

[

A = 1000 \cdot e^{(0.05 \cdot 5)} = 1000 \cdot e^{0.25} \approx 1000 \cdot 1.28403 = 1284.03

]

After 5 years, with continuous compounding, your investment would grow to approximately $1,284.03.

Using a Continuous Compound Interest Calculator

A Continuous Compound Interest Calculator automates the calculation, allowing users to input values such as the principal amount, interest rate, and investment duration to quickly determine the future value of their investment.

- Input Parameters: Users need to enter the principal amount, the annual interest rate, and the investment duration (in years).

- Calculation: The calculator uses the continuous compound interest formula to compute the final amount.

- Result: The future value of the investment is displayed, showing how much the initial principal will grow under continuous compounding.

These calculators are especially useful for investors who want to understand the maximum potential growth of their investments under the assumption of continuous compounding.

Importance in Finance and Investing

Continuous compounding is a critical concept in finance, particularly in fields like banking, investment management, and financial engineering. It provides a more precise estimation of returns compared to discrete compounding methods and is often used in pricing models for financial derivatives and other complex instruments.

For long-term investments, understanding the implications of continuous compounding can help investors make more informed decisions. It highlights the importance of the compounding frequency in maximizing returns, emphasizing the power of reinvesting earnings as frequently as possible.

Limitations and Considerations

While continuous compounding offers theoretical advantages, it is important to note that in real-world scenarios, interest is not compounded continuously. Banks and financial institutions typically offer interest that compounds at specific intervals, such as daily, monthly, or annually.

Moreover, the differences between continuous compounding and more frequent compounding intervals (like daily compounding) may be minimal over short periods or for small interest rates. Therefore, while the concept is valuable for understanding potential growth, actual returns depend on the terms of the specific financial product.

Conclusion

A Continuous Compound Interest Calculator is a powerful tool for understanding the potential growth of investments under the assumption of continuous compounding. While it represents an idealized scenario, it provides valuable insights into the effects of compounding on wealth accumulation. For those looking to maximize their returns, understanding both continuous and traditional compounding methods is crucial to making informed financial decisions.

Investors should consider using this calculator to experiment with different scenarios, helping them visualize how various interest rates, principal amounts, and time periods can affect the future value of their investments.

Different Types of Compound Interest Calculators for Smart Financial Planning

one of the most powerful concepts is compound interest. Understanding how compound interest works can significantly impact investment decisions, retirement planning, and overall financial growth. One essential tool for harnessing this power is an Investment Growth Compound Interest Calculator. This calculator helps investors forecast the growth of their investments over time by factoring in compound interest, which enables money to grow exponentially rather than linearly.

What is Compound Interest?

Compound interest is interest on both the initial principal and the accumulated interest from previous periods. In simple terms, it’s the interest you earn on your interest. Unlike simple interest, which is calculated only on the initial investment (or principal), compound interest allows your money to grow at an accelerating rate over time.

Mathematically, compound interest can be calculated using the formula:

[

A = P \times \left(1 + \frac{r}{n}\right)^{nt}

]

Where:

- A is the amount of money accumulated after n years, including interest.

- P is the principal amount (the initial investment).

- r is the annual interest rate (in decimal form).

- n is the number of times that interest is compounded per year.

- t is the number of years the money is invested for.

How Does an Investment Growth Compound Interest Calculator Work?

An Investment Growth Compound Interest Calculator simplifies the above calculation by allowing you to input your initial investment, interest rate, compounding frequency, and the duration of the investment. The calculator then provides you with an estimate of how much your investment will grow over time.

For example, let’s assume you invest $10,000 at an annual interest rate of 5%, compounded monthly, for 10 years. Using the calculator, you can quickly determine how much your investment will be worth at the end of the period.

The key components that influence the outcome of the calculation are:

- Initial Investment (Principal): The starting amount of money you invest.

- Annual Interest Rate: The percentage at which your investment grows annually.

- Compounding Frequency: How often interest is added to the principal. Common frequencies include annually, semi-annually, quarterly, monthly, or daily.

- Investment Period: The length of time you plan to keep your money invested.

Benefits of Using a Compound Interest Calculator

- Visualization of Growth: A compound interest calculator provides a clear picture of how your investment can grow over time, allowing you to make informed decisions.

- Scenario Analysis: By adjusting the variables (e.g., interest rate, time horizon), you can explore different investment scenarios and their outcomes. This helps in understanding how small changes in interest rates or compounding frequency can significantly impact your returns.

- Goal Setting: The calculator can be used to set realistic investment goals. For instance, if you want to save for retirement, you can determine how much you need to invest and for how long to reach your desired retirement fund.

- Education: For beginners in the world of finance, using a compound interest calculator is an excellent way to learn about the impact of compound interest and to understand the importance of starting investments early.

Real-World Applications

- Retirement Planning: Many people use compound interest calculators to estimate the growth of their retirement savings. By inputting the expected return rate and the number of years until retirement, they can get an idea of how much their savings will be worth in the future.

- Savings Accounts: Banks offer interest on savings accounts, and a compound interest calculator can help determine how much your money will grow based on the interest rate and how often it is compounded.

- Investment Portfolios: Investors use these calculators to forecast the growth of their portfolios, especially when considering long-term investments like stocks, bonds, or mutual funds.

Example Calculation

Let’s take an example to illustrate the impact of compound interest using a compound interest calculator.

- Initial Investment (Principal): $10,000

- Annual Interest Rate: 5%

- Compounding Frequency: Monthly

- Investment Period: 10 years

Using the compound interest formula or a calculator, the future value of the investment would be approximately $16,470. This means that after 10 years, your initial $10,000 investment will have grown by $6,470 thanks to compound interest.

Final Thoughts

An Investment Growth Compound Interest Calculator is a powerful tool for anyone looking to grow their wealth over time. By helping you visualize how your investments will accumulate interest, it provides valuable insight into the importance of compounding. Whether you’re saving for retirement, building a college fund, or simply growing your wealth, understanding and leveraging compound interest can significantly impact your financial success.

Using this calculator effectively can be the key to achieving your financial goals and making the most of your investments.

Which Is The Best Compound Interest Calculators for Students

Compound interest calculators are invaluable for students to understand how their investments or savings grow over time. They help visualize the effects of interest compounding, which can be crucial for both personal finance management and academic understanding. Below is a comprehensive guide to some of the best compound interest calculators, highlighting their features, pros, and cons.

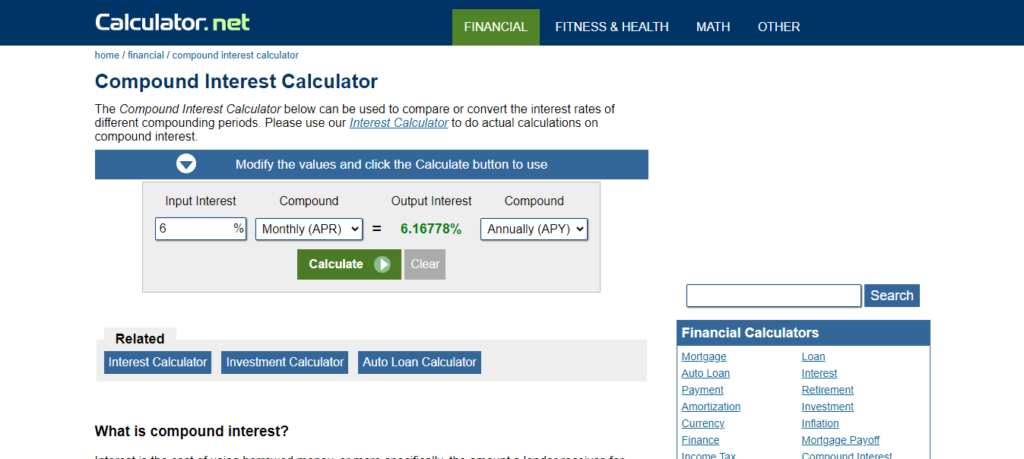

1. Calculator.net Compound Interest Calculator

Description:

Calculator.net offers a straightforward online compound interest calculator. It allows users to input the initial principal amount, annual interest rate, number of compounding periods per year, and investment duration. Users can also include additional regular deposits or withdrawals.

Features:

- Customization of Compounding Frequency: Choose from annual, semi-annual, quarterly, monthly, or daily compounding.

- Detailed Breakdown: Provides a clear summary of principal, interest earned, and future value.

- Visual Graphs: Displays growth over time through charts.

Pros:

- Ease of Use: Simple and intuitive interface suitable for beginners.

- Free Access: No cost involved, and it can be accessed from any device with internet.

- Educational Value: Offers visual aids to better understand interest accumulation.

Cons:

- Limited Offline Access: Only available online; no mobile app or offline version.

- Basic Features: Advanced scenarios may require a premium version.

2. Investopedia Compound Interest Calculator

Description:

Investopedia’s calculator is a comprehensive tool for understanding compound interest. It allows for input of initial investment, annual interest rate, number of years, and compounding frequency. The results include detailed information on total interest earned and future value.

Features:

- Customizable Inputs: Adjust initial amount, interest rate, duration, and compounding frequency.

- Detailed Results: Provides a thorough breakdown of future value and interest earned.

- Educational Resources: Includes explanations and additional information on compound interest.

Pros:

- User-Friendly Design: Clean and visually appealing layout.

- Free to Use: Accessible without any cost, with educational support.

- Clear Explanations: Helpful for understanding the underlying financial concepts.

Cons:

- Limited Advanced Features: Basic functionality may not cover all complex scenarios.

- Web-Based Only: No mobile app or offline functionality.

3. Bankrate Compound Interest Calculator

Description:

Bankrate’s compound interest calculator is designed for those who need a detailed analysis of their investments. It supports various compounding frequencies and allows users to input regular contributions, providing a comprehensive view of how investments grow over time.

Features:

- Flexible Inputs: Allows for customization of initial investment, interest rate, time period, and compounding frequency.

- Visual Growth Chart: Displays a graphical representation of how investments accumulate.

- Detailed Output: Offers a breakdown of future value and total interest earned.

Pros:

- In-Depth Analysis: Provides detailed results and charts for better understanding.

- No Registration Required: Use the basic features without creating an account.

- Free Access: Available at no cost on the Bankrate website.

Cons:

- Advertisements: The website includes ads which might be distracting.

- Complex Scenarios: Some advanced calculations may require additional tools or subscriptions.

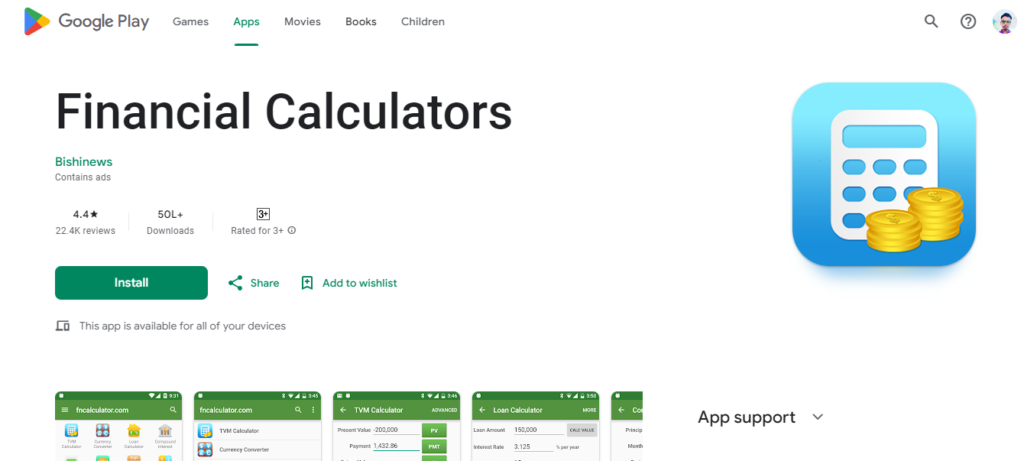

4. Financial Calculator App (Mobile)

Description:

The Financial Calculator app provides a suite of financial calculators, including a compound interest calculator, available for both iOS and Android devices. It allows users to perform calculations on-the-go and customize scenarios as needed.

Features:

- Mobile Accessibility: Available as an app for both major mobile platforms.

- Multi-Functionality: Includes various financial calculators in one app.

- Customizable: Allows for detailed adjustments and input of additional contributions.

Pros:

- Convenience: Portable and suitable for on-the-go calculations.

- Versatility: Offers multiple financial tools beyond just compound interest.

- Graphical Results: Provides visual representations of calculations.

Cons:

- Paid Features: Some advanced functionalities require a paid version.

- Interface Complexity: The app can be cluttered with multiple tools and options.

5. Excel Compound Interest Calculator Template

Description:

The Excel compound interest calculator template is a customizable spreadsheet tool available in Microsoft Excel or Google Sheets. It allows students to tailor their calculations and create detailed projections based on their specific scenarios.

Features:

- High Flexibility: Users can modify formulas and inputs to fit various needs.

- Custom Scenarios: Adaptable for complex calculations and different compounding frequencies.

- Graphical Elements: Users can create charts to visualize growth over time.

Pros:

- Customizable: Highly adaptable for individual requirements.

- Widely Used: Familiarity with Excel or Google Sheets can be an advantage.

- No Additional Cost: Typically included with office software or free Google Sheets.

Cons:

- Requires Knowledge: Basic understanding of spreadsheets and formulas needed.

- No Pre-Built Visuals: Requires manual setup for charts and visual aids.

Conclusion

Choosing the best compound interest calculator depends on the student’s needs, such as the level of detail required, accessibility preferences, and whether a mobile or web-based tool is preferred. For ease of use and straightforward calculations, Calculator.net and Investopedia are excellent options. For detailed analysis and visual aids, Bankrate and mobile apps offer comprehensive tools. For those comfortable with spreadsheets, the Excel template provides unparalleled flexibility.

Each tool has its own set of advantages and limitations, so students should select one that best fits their financial learning goals and technical comfort level.

What Is The Benefits of Using a Compound Interest Calculator

In finance and investing, compound interest is a powerful concept that can significantly impact the growth of your savings and investments over time. Understanding and leveraging compound interest can be challenging, but a compound interest calculator simplifies this process. Here’s a detailed look at the benefits of using a compound interest calculator:

1. Simplifies Complex Calculations

Compound interest involves calculating interest on both the initial principal and the accumulated interest from previous periods. This can be complex to compute manually, especially with varying interest rates and compounding frequencies. A compound interest calculator automates these calculations, saving time and reducing the risk of errors.

2. Visualizes Growth Over Time

A compound interest calculator provides a clear visualization of how investments or savings will grow over time. By inputting different variables—such as the initial amount, interest rate, and compounding frequency—the calculator generates detailed projections. This helps users understand the exponential growth of their investments and how small changes in variables can impact future returns.

3. Helps with Financial Planning

Planning for future financial goals, such as retirement or education expenses, requires accurate projections of how savings will grow. A compound interest calculator allows users to model different scenarios and see how their investments or savings will evolve over time. This assists in setting realistic goals and making informed decisions about how much to save or invest regularly.

4. Compares Different Investment Options

Investors often have multiple options for where to place their money, each with different interest rates and compounding frequencies. A compound interest calculator enables users to compare these options by inputting different interest rates and compounding periods. This comparison helps in selecting the most profitable investment strategy.

5. Illustrates the Power of Compounding

One of the key benefits of compound interest is its ability to generate earnings on previous earnings, leading to exponential growth. A compound interest calculator highlights the impact of this “interest on interest” effect, demonstrating how even small amounts invested over a long period can grow significantly.

6. Aids in Understanding Different Compounding Frequencies

Interest can be compounded annually, semi-annually, quarterly, monthly, or daily. A compound interest calculator allows users to explore how different compounding frequencies affect their returns. This knowledge can help individuals make more informed decisions about where to place their money and how often to reinvest earnings.

7. Supports Budgeting and Savings Goals

For those focused on budgeting and saving, a compound interest calculator can help set savings targets by showing how much needs to be saved regularly to reach a specific financial goal. It can also project the future value of current savings, helping individuals assess whether they’re on track to meet their objectives.

8. Educational Tool for Financial Literacy

Using a compound interest calculator can be an educational experience, helping users understand key financial concepts such as interest rates, time periods, and the effect of compounding. This enhanced financial literacy can lead to better personal finance management and more informed investment decisions.

9. Immediate Results

Unlike manual calculations, which can be time-consuming, a compound interest calculator provides immediate results. This instant feedback allows users to quickly test various scenarios and make adjustments as needed, facilitating more dynamic financial planning and decision-making.

10. Customizable and Flexible

Many compound interest calculators offer customizable features, allowing users to input specific details tailored to their unique financial situations. This flexibility ensures that the projections and comparisons are relevant and accurate, aligning with personal financial goals and circumstances.

Conclusion

In summary, a compound interest calculator is a valuable tool for anyone looking to optimize their financial planning, investment strategy, and savings growth. By simplifying complex calculations, visualizing growth, aiding in comparisons, and enhancing financial literacy, it provides critical insights that can lead to more informed and strategic financial decisions. Whether you’re a seasoned investor or just starting to plan for your future, leveraging a compound interest calculator can significantly benefit your financial journey.

How Many Types of Compound Interest Calculators

Compound interest is a powerful concept in finance, where interest is calculated on the initial principal and also on the accumulated interest of previous periods. This “interest on interest” effect can significantly increase the value of investments or savings over time. A compound interest calculator helps individuals and businesses estimate the future value of their investments or loans by accounting for this compounding effect.

There are various types of compound interest calculators available, each catering to different financial needs. Below, we explore the most common types and their applications.

1. Basic Compound Interest Calculator

This is the most straightforward type of compound interest calculator. It calculates the future value of an investment or savings account based on the initial principal, interest rate, and the number of compounding periods. Users input these values, and the calculator provides the final amount after a specified period.

Common use case: For individuals who want to estimate the growth of their savings over time, such as in a regular savings account or a certificate of deposit (CD).

Example Inputs:

- Principal: $10,000

- Annual Interest Rate: 5%

- Compounding Frequency: Annually

- Time: 10 years

The calculator will show the future value based on these inputs.

2. Advanced Compound Interest Calculator

An advanced compound interest calculator includes additional features such as variable interest rates, contributions, withdrawals, or changes in the compounding frequency over time. These calculators allow for more dynamic scenarios, reflecting real-life investment situations where contributions might be made periodically, or where the interest rate changes after a certain period.

Common use case: Ideal for more complex financial planning, such as retirement savings where contributions are made regularly, or for businesses projecting cash flow over multiple periods with changing interest rates.

Example Inputs:

- Initial Principal: $5,000

- Monthly Contribution: $200

- Interest Rate: 4% (changes to 5% after 5 years)

- Compounding Frequency: Monthly

- Time: 20 years

The calculator would provide a detailed breakdown of how contributions and interest accumulation impact the final amount.

3. Loan Compound Interest Calculator

This type of calculator is tailored for loans that charge compound interest. Instead of focusing on savings or investment growth, it calculates how much interest will accrue on a loan and how that impacts the total repayment amount. These calculators are crucial for understanding the total cost of a loan, including mortgages, auto loans, or student loans.

Common use case: Borrowers use this calculator to determine how much they will end up paying over the life of a loan, including the effects of compounding interest on their monthly payments.

Example Inputs:

- Loan Amount: $50,000

- Annual Interest Rate: 6%

- Compounding Frequency: Monthly

- Loan Term: 15 years

This calculator will show the total interest paid over the loan period and the monthly payment amount.

4. Investment Growth Compound Interest Calculator

Investment-specific calculators focus on the growth of different types of investments, such as stocks, bonds, or mutual funds. These calculators often include options to account for varying rates of return, inflation, and risk factors, providing a more comprehensive view of potential investment outcomes.

Common use case: Investors use this calculator to estimate the future value of their investment portfolios, considering different annual returns and market conditions.

Example Inputs:

- Initial Investment: $25,000

- Expected Annual Return: 7%

- Compounding Frequency: Quarterly

- Time: 30 years

The calculator will project the future value of the investment based on different growth scenarios.

5. Continuous Compound Interest Calculator

In some financial contexts, interest is compounded continuously, meaning the compounding occurs at every possible moment. This is in contrast to periodic compounding (e.g., monthly, annually). A continuous compound interest calculator uses a specific mathematical formula to determine the future value of an investment or loan with continuous compounding.

Common use case: Used in more advanced financial scenarios or theoretical calculations where continuous growth or interest accumulation is assumed, such as in certain advanced investment strategies or in fields like economics and physics.

Example Inputs:

- Principal: $8,000

- Annual Interest Rate: 4.5%

- Time: 10 years

The calculator uses the formula ( A = P \times e^{rt} ) to calculate the future value, where ( e ) is Euler’s number (approximately 2.71828).

6. Retirement Compound Interest Calculator

This type of calculator is specifically designed for retirement planning. It factors in regular contributions, employer matches (if applicable), and the expected return on investments to project the total retirement savings at the time of retirement. Some calculators also allow for the inclusion of inflation and withdrawal rates during retirement.

Common use case: Individuals planning for retirement use this calculator to estimate how much they need to save regularly to achieve their desired retirement nest egg, considering compounding interest over the years.

Example Inputs:

- Current Age: 35

- Retirement Age: 65

- Current Savings: $20,000

- Monthly Contribution: $500

- Annual Return: 6%

- Compounding Frequency: Monthly

The calculator will project the total retirement savings and help determine if adjustments need to be made to contributions.

Conclusion

Compound interest calculators are essential tools for financial planning, and their different types cater to various needs—from basic savings calculations to complex investment and loan scenarios. Whether you’re planning your retirement, calculating the cost of a loan, or estimating the growth of an investment, using the right type of compound interest calculator will provide valuable insights and help you make informed financial decisions.

Top 5 Best Compound Interest Calculators in 2024

Compound interest is one of the most powerful forces in personal finance, enabling your investments or savings to grow exponentially over time. Whether you’re planning for retirement, saving for a big purchase, or just curious about how your money can grow, a reliable compound interest calculator can be a game-changer. Here, we review the top five compound interest calculators in 2024, designed to make financial planning easier and more accurate.

1. Bankrate Compound Interest Calculator

Overview:

Bankrate is a well-established name in the financial industry, known for its tools and calculators that help users make informed financial decisions. Their compound interest calculator is one of the most user-friendly tools available.

Features:

- Simple, clean interface

- Adjustable frequency of compounding (daily, monthly, quarterly, annually)

- Option to include regular contributions

- Provides a detailed breakdown of interest earned over time

Conclusion

Bankrate’s compound interest calculator excels due to its simplicity and ease of use. It’s ideal for beginners who are new to the concept of compound interest but still provides enough flexibility for more advanced users.

2. Investor.gov Compound Interest Calculator

Overview:

The Investor.gov compound interest calculator, developed by the U.S. Securities and Exchange Commission (SEC), is an excellent tool for those who want a trustworthy and accurate calculation, free from commercial bias.

Features:

- No ads or distractions

- Clear and straightforward layout

- Includes fields for initial investment, time horizon, annual interest rate, and regular contributions

- Highlights the impact of different investment time frames

Conclusion

Because it’s offered by a government body, this calculator is highly reliable and provides an unbiased platform for calculating compound interest. It’s perfect for anyone looking for a simple, no-nonsense calculator without the frills.

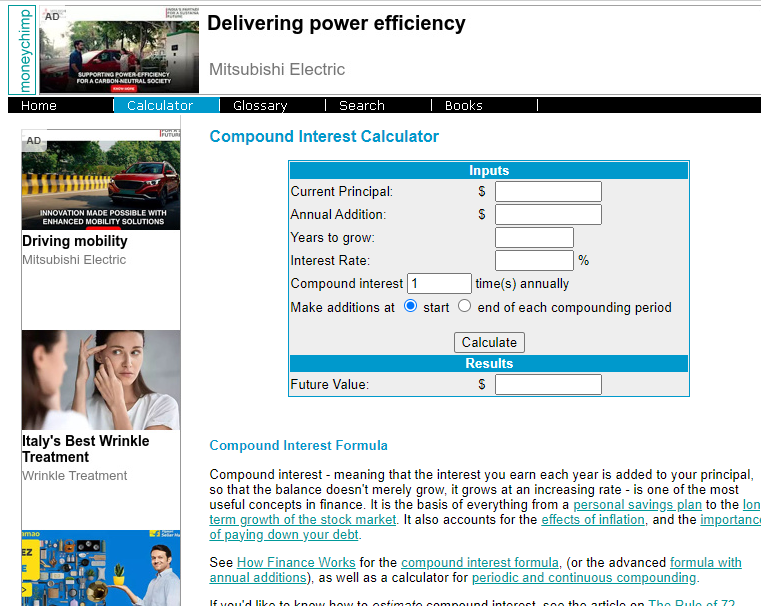

3. Moneychimp Compound Interest Calculator

Overview:

Moneychimp offers a compound interest calculator that stands out for its minimalistic design and ease of use. It provides a quick snapshot of how your money will grow over time, making it great for quick calculations.

Features:

- Simple input fields

- Graphical representation of growth over time

- Option to adjust the compounding frequency

- Provides final balance along with interest earned

Conclusion

The Moneychimp calculator is great for visual learners, as it provides an easy-to-understand graph that shows how your investment grows over time. It’s a perfect choice for anyone who prefers visual data representation over numbers.

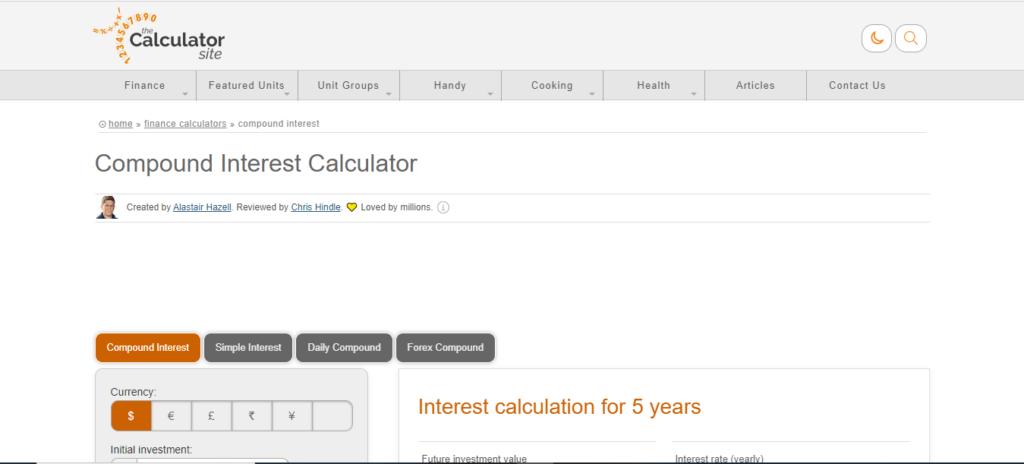

4. The Calculator Site Compound Interest Calculator

Overview:

The Calculator Site offers a versatile compound interest calculator that is packed with features and customization options, making it suitable for both casual users and financial professionals.

Features:

- Ability to include regular deposits or withdrawals

- Customizable compounding periods (monthly, yearly, etc.)

- Supports multiple currencies

- Detailed results with options to display annual breakdowns

Conclusion

This calculator is highly customizable, allowing users to input a wide range of variables. It also supports different currencies, which makes it a great tool for international users or those with global investments.

5. NerdWallet Compound Interest Calculator

Overview:

NerdWallet’s compound interest calculator is designed with user experience in mind. It combines simplicity with insightful results, offering a great tool for planning long-term investments.

Features:

- Interactive design with easy-to-understand fields

- Provides both future value and interest earned

- Includes a slider to adjust the time horizon

- Mobile-friendly interface

Conclusion

NerdWallet’s calculator offers a modern, interactive design that makes it fun to experiment with different scenarios. It’s ideal for users who want a bit more interactivity and a visually appealing interface, all while remaining mobile-friendly for on-the-go calculations.

Conclusion

Whether you’re just starting your financial journey or you’re a seasoned investor, having a reliable compound interest calculator is essential for planning and forecasting. These top five tools are some of the best available in 2024, offering a range of features that cater to different needs and preferences. From the simplicity of Bankrate’s calculator to the customizability of The Calculator Site’s tool, there’s something here for everyone.